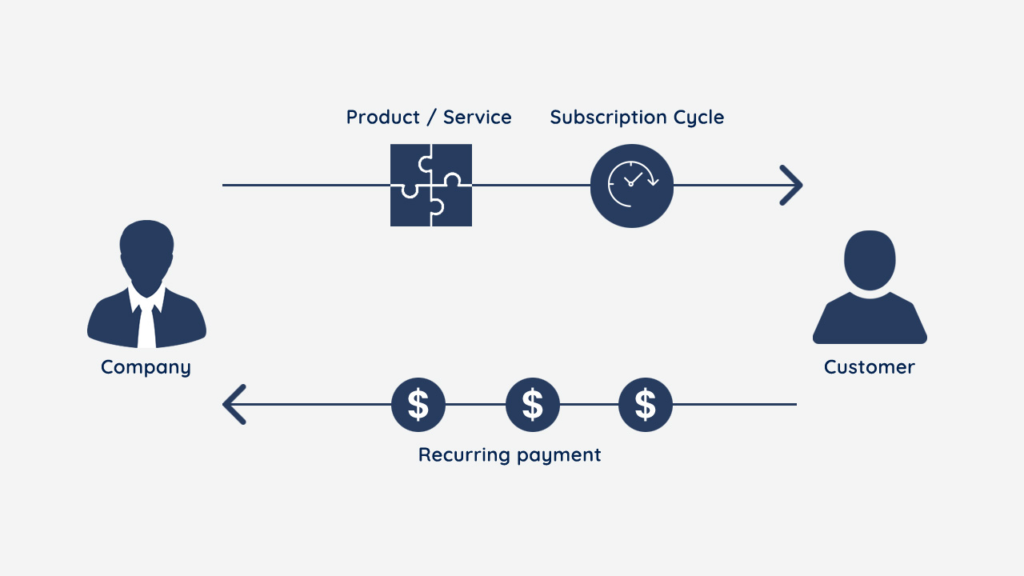

Netflix, Spotify, and PlayStation – these brands operate in different industries, but have one thing in common – they successfully operate on a subscription business model.

Subscriptions are suitable for the sale of a wide variety of goods and services, from monthly beauty boxes to movie streaming. The subscription format is not limited to a few niches, and almost any company can use it.

The concept of ownership is gradually receding into the background and more and more people are willing to pay for the right to use it.

A study by Zuora showed that today users have more subscriptions than ever before, and they do not exclude that they will subscribe to other services in the future. About a third of respondents believe that they will have even more subscriptions in two years than they do now.

Distinctive features of the subscription business model

According to McKinsey, the subscription-based eCommerce market is projected to reach $473 billion by 2025. The subscription business model help companies capitalize on an ongoing relationship with customers.

There are 5 distinctive features of the subscription business model in eCommerce.

Less price – more customers

It is usually easier for a person to pay $60 per month for something than to pay $6000 for it right away. This factor greatly reduces the barrier to entry for new clients.

For relatively little money, a person immediately gets access to the service – and this plays a key role for him or her.

Projected income

You need to constantly attract new customers to a business with one-time sales. And even in one unsuccessful month, you can go into deficit.

That means you’ll have to spend even more money to attract them. The subscription business model helps to avoid these risks: users who have subscribed to the service are already loyal customers.

So, monthly recurring revenue helps forecast sales, plan inventory and understand how much to reinvest for business growth. Receiving monthly advances means more cash flow for your startup.

Promotion is more profitable

One-time payment business models have a customer acquisition cost rate (CAC).

In the case of subscription, CAC remains the same (depending on the marketing and conversion route). The profit of one customer over the whole period of work with him or her (LTV) gradually increases – until he or she unsubscribes.

With a subscription business model, you have more opportunities for cross-selling. The more customers use your products, the more credibility you have. This makes it easier to sell them additional products because they already know you represent value.

Good Read: How to Leverage AI to Upsell and Cross Sell

It’s easier to increase loyalty

The subscription business model allows a business to be in constant contact with the customer. This opens up great opportunities to promote their products, additional options, and more as they become loyal to your brand.

With a subscription already in place, it’s easier for a customer to make new purchases or, for example, switch to another subscription model on the same service.

In addition, regular customers who have been subscribed to the service for a long time tend to be loyal to it. They promote it themselves among their friends.

At the same time, regular purchases give you more insight into customer behavior. You can continually improve products and keep customers coming back for more.

Good Read: 4 Benefits of Having a Strong Customer Loyalty Program

It’s easy to check the service or product

Many subscription services offer a free trial period.

In the case of one-time purchases, the user does not always have the opportunity to try the product. This greatly increases the entry threshold for new customers.

Of course, there is no guarantee that after the free period the person will take a paid subscription, but even in this case, the business still has the contacts of a potential customer.

This means there is an opportunity to get feedback, make the product better and try to bring the user back.

Key metrics of a subscription business in eCommerce

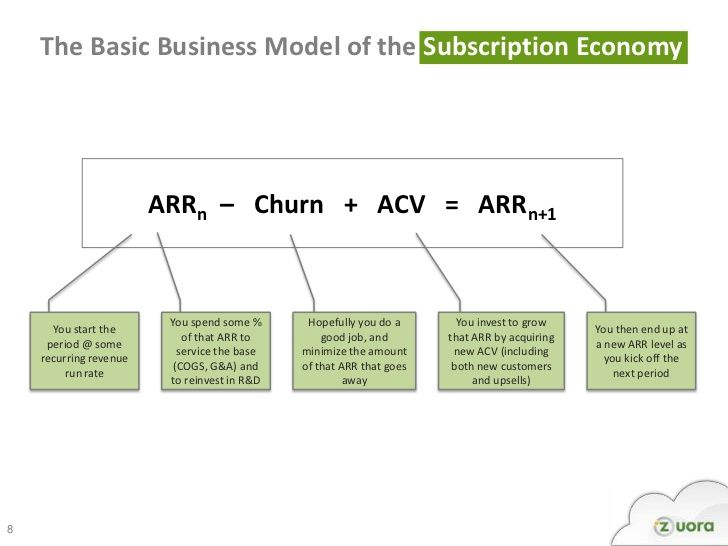

As early as the beginning of the fiscal year, a business built on the subscription business model can predict annual recurring revenue (ARR).

Importantly, in this case, we are talking about a constant volume of regular payments, without taking into account one-time payments.

However, churn should be taken into account, as well as revenues not received from unsubscribers. The annual contract value (ACV) allows for increasing income.

As a result, the formula is the following (n – year).

ARRn – Churn + ACV = ARRn + 1

Traditionally, the calculation is carried out following the results of the period. The subscription business model is characterized by the understanding (even if approximate) of the situation at the beginning of the year.

The predictability of revenues allows for planning the expenses (how much to invest in the development of products, whether to hire a new employee).

And now we move directly to the key metrics, on the basis of which the effectiveness of the subscription business model is estimated.

Customer churn rate

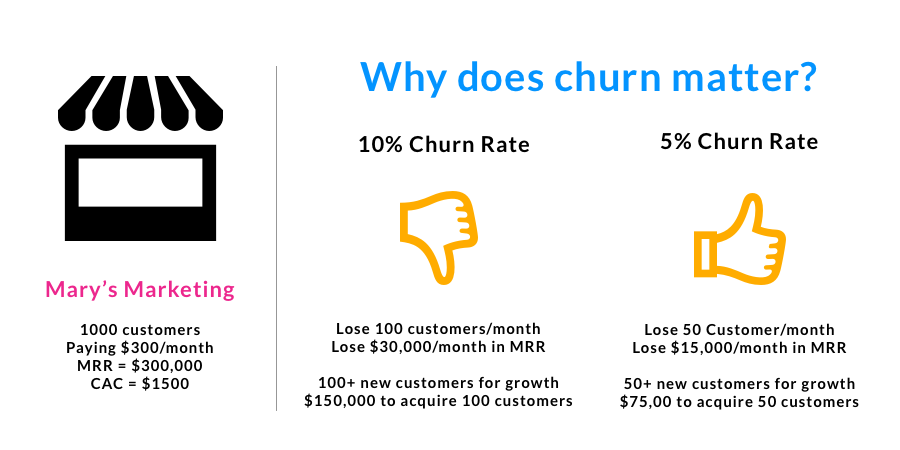

Customers lost by a business are revenues that fall out and should be deducted from the ARR. But how do you determine the customer churn rate? Different methods are used.

For example, Andreessen Horowitz divides the number of customers left by the number of customers at the beginning of the counting period (new deals made during that time are not counted).

A different monthly churn rate will be normal for each area. For example, for some services 20% churn is normal, while cloud-based subscription services cannot exceed 5-7%. The lower the churn, the more interest investors have in the business.

Let’s say the projected revenue by the end of the year is $100, from which you must subtract 10% of churn (a very realistic figure for B2B), – we get $90 in annual revenue. Even a very modest percentage of lost customers is not good for the overall result.

The churn rate metric will allow you to understand how many new subscribers you need to bring in to meet your revenue plan.

Good Read: How to Reduce Customer Churn Rate With Content Marketing

Repeatable revenue

This metric represents the difference between recurring revenue and recurring expenses. Accordingly, the higher the metric, the more free money the business has.

Let’s say that out of our $90 planned revenue, a portion needs to be invested in maintaining the quality features of the subscription service (e.g., data center costs for a SaaS company). This is the cost of sold goods (COGS), for which we will spend, let’s say, about $20.

Another $10 will be spent on business administration. This is a wide range of tasks related to accounting, legal support, and the cost of renting office space.

Don’t forget about research and development (R&D) – these recurring costs are largely made up of the cost of engineers’ salaries. In our example, we’ll budget $20 of annual revenue for this.

We will lose $10 due to the outflow of subscribers, $20 will be spent to maintain the quality of service, another $10 will be spent on administration, and $20 will be spent on innovations, which first must be developed, and then competently implemented.

Thus, from the original planned $100, income was only $40. That is, 40% of revenue. They can be spent on business development.

The amount of revenue is directly related to recurring costs: the higher the latter, the lower the former. By calculating the amount of anticipated revenue, the company will be able to understand how much money is left for development.

The subscription business model makes it possible to calculate prospects. A business that does not use subscriptions will have a much less accurate forecast due to not knowing the annual number of customers and the amount that customers will spend on transactions.

Growth efficiency ratio

The profits of the business (in our example it is $40) can be distributed among the owners of the firm in the form of dividends. Or you can invest them in the development of the sales department and marketing campaigns, previously calculating the growth efficiency ratio.

How much can you earn on investments in marketing and sales of products? If you spend $1, what will be the amount of recurring revenue? In B2B for a SaaS company with an in-house sales team, a 1:1 ratio (per dollar of investment, a dollar of revenue) is normal.

Of course, each area and even each business has different rates of normality. Someone can invest $0.5 in sales and get one dollar in revenue. This is possible in areas with low competition if the company has a favorable market position.

For example, the only cab in town will be in demand in any case, even if the owner will cut costs on sales organization and will not invest in marketing.

Conclusion

The subscription business model in the future. That’s why any business needs to figure out if the subscription format is right for them.

Even if it doesn’t fit at all, that’s no reason to give up right away. It may be worthwhile to readjust to the subscription format now so that the future doesn’t take the business by surprise.